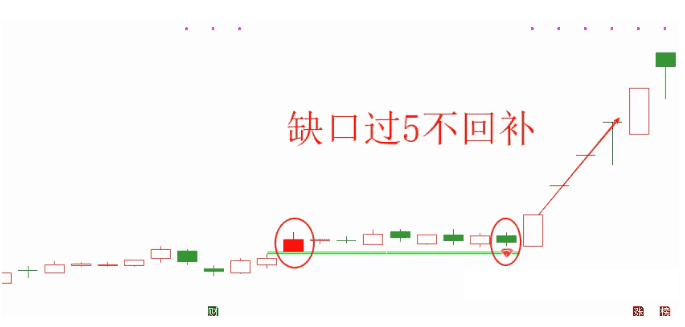

主图中显示的红色k线,是跳空高开留下缺口的一根k线,这个k线最好不要是涨停板,是小阳线最好,量能必须是放量的,倍量最好;

随后开始震荡调整,整个调整期间,整体的振幅很小,说明主力锁仓程度很深;

震荡过程中,量能也是萎缩的,是相对于缺口的红色k线那一天的量能来说是缩量;

整个的调整时间超过一周,也就是超过5个交易日,越长越好;

主图中的绿色水平线,就是缺口的上下限;

当某一天,量能萎缩到极致,会出现进场点信号,也就是主图中的红钻信号,选股指标就是做出整个位置的选股;

选股时间是尾盘或者盘后,因为需要全天成交量走完才能确认量能是否达到标准,进场点是次日开盘,止损是缺口回补止损;

一.缺口过5不回Z

SH:=CODELIKE('00') OR CODELIKE('60');

SZ:=CODELIKE('30') OR CODELIKE('68');

SS:=FINANCE(3)=2;{公众号指标策略}

X1:=IF(SH,0.1,IF(SZ,0.2,IF(SS,0.3,100)));

ZT:=C=H AND C>=ZTPRICE(REF(C,1),X1);

T1:=C>O AND L>REF(H,1) AND V>REF(V,1);

STICKLINE(T1,C,O,3,0),COLORRED;

STICKLINE(T1,H,L,0,0),COLORRED;

STICKLINE(T1,L,L,8,0),COLORGREEN;{公众号指标策略}

STICKLINE(T1,REF(H,1),REF(H,1),8,0),COLORGREEN;

N1:=BARSLAST(T1);{公众号指标策略}

T2:=EVERY(V<REF(V,N1) AND L>REF(H,N1+1),N1) AND HHV(H,N1)/LLV(L,N1)<1.05;

STICKLINE(T2,REF(L,N1),REF(L,N1),4,0),COLORGREEN;{公众号指标策略}

STICKLINE(T2,REF(H,N1+1),REF(H,N1+1),4,0),COLORGREEN;

T3:=T2 AND V<REF(V,N1)/2 AND N1>5;{公众号指标策略}

DRAWICON(T3,L,25);

SH:=CODELIKE('00') OR CODELIKE('60');

SZ:=CODELIKE('30') OR CODELIKE('68');

SS:=FINANCE(3)=2;{公众号指标策略}

X1:=IF(SH,0.1,IF(SZ,0.2,IF(SS,0.3,100)));

ZT:=C=H AND C>=ZTPRICE(REF(C,1),X1);

T1:=C>O AND L>REF(H,1) AND V>REF(V,1);

N1:=BARSLAST(T1);{公众号指标策略}

T2:=EVERY(V<REF(V,N1) AND L>REF(H,N1+1),N1) AND HHV(H,N1)/LLV(L,N1)<1.05;{公众号指标策略}

XG:T2 AND V<REF(V,N1)/2 AND N1>5;

三.缺口过5不回X

SH:=CODELIKE('00') OR CODELIKE('60');

SZ:=CODELIKE('30') OR CODELIKE('68');

SS:=FINANCE(3)=2;{公众号指标策略}

X1:=IF(SH,0.1,IF(SZ,0.2,IF(SS,0.3,100)));

ZT:=C=H AND C>=ZTPRICE(REF(C,1),X1);

T1:=C>O AND L>REF(H,1) AND V>REF(V,1);

N1:=BARSLAST(T1);{公众号指标策略}

T2:=EVERY(V<REF(V,N1) AND L>REF(H,N1+1),N1) AND HHV(H,N1)/LLV(L,N1)<1.05;{公众号指标策略}

XG:T2 AND V<REF(V,N1)/2 AND N1>5;